In my last post, I wrote about a study that predicts increases in the minimum wage will lead to significantly more restaurant closures. Clearly, many restaurants and bars are unable (or failed) to raise their prices in response to increases in the minimum wage, resulting in their ultimate demise. Continue reading “How Much will Minimum Wage Hikes Affect Your Prices?”

Will Your Restaurant Survive The Minimum Wage Hike?

Premier Kathleen Wynn has announced that Ontario’s minimum wage will be increasing, substantially, over the next year and a bit. Based on studies done in other places, the jump in wages is likely to have a significant impact on small businesses, especially restaurants and bars. Continue reading “Will Your Restaurant Survive The Minimum Wage Hike?”

You're Probably Using the Wrong KPIs

Recently, I’ve been doing a lot of work implementing KPIs for restaurants and bars. For those of you who may not know, KPIs are Key Performance Indicators. Statistics, or metrics, about your business, that you can track to monitor your performance toward key objectives, such as profitability and growth. Continue reading “You're Probably Using the Wrong KPIs”

Recently, I’ve been doing a lot of work implementing KPIs for restaurants and bars. For those of you who may not know, KPIs are Key Performance Indicators. Statistics, or metrics, about your business, that you can track to monitor your performance toward key objectives, such as profitability and growth. Continue reading “You're Probably Using the Wrong KPIs”

Targeting Groupon Diners

If I had been the founder of Groupon when Google offered up $6 billion for it, the door wouldn’t have hit me on the back-side as I rushed to the bank to cash the cheque! While I think Groupon is an interesting concept, they are really greedy, and ultimately, it will be their downfall. Let me explain.

Groupon seeks out businesses that are willing to offer deep discounts for their goods and services. Usually, the discounts are around 50%. Groupon takes another 25% or so for publicizing the offer and collecting the funds from the bargain-hunters. That leaves the business with only 25% of what it would normally take in on a sale.

Groupon talks businesses into signing up by claiming that they may lose a bit on the first sale, but they will make it up on subsequent sales. Nonsense. Alternatively, if businesses have excess capacity, they can accommodate lower-paying customers, because they only have to cover the incremental (or marginal) cost of servicing the customer. This works for spas and other similar businesses. There aren’t too many businesses that have a marginal cost less than 25%.

What about restaurants? They are probably the most popular Groupon category, based on demand. Is it worth it for a restaurant to sign up for Groupon?

Continue reading “Targeting Groupon Diners”

QuickBooks Accounting for Groupon

I’m almost finished with Groupon articles! I’ve got two more, then, I think we’re done. I’ve been writing these articles, because there is a lot of confusion surrounding the accounting for Groupon certificates and how to enter them in QuickBooks. The resources for learning about these areas are poor (and often contradictory), but that’s nothing compared with the confusing, and often downright incorrect, information that has been written about the tax implications of using Groupon! I hope these articles will help accountants, bookkeepers and restaurant owners set up their books and account for these transactions properly.

Today’s article explains how to account for a restaurant’s Groupon transactions in QuickBooks. Previous articles have covered the POS system set up for Groupon transactions, accounting for Groupon transactions (in general), and the very important tax implications of using Groupon in a restaurant.

Continue reading “QuickBooks Accounting for Groupon”

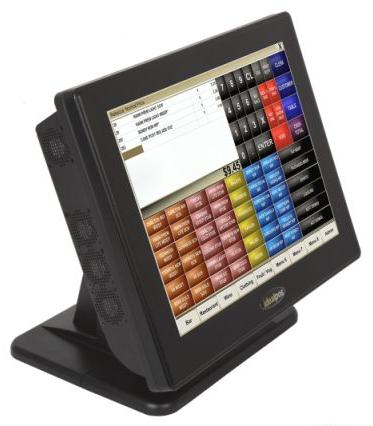

Groupon POS Implications

This is the second article in a series about Groupon coupons for restaurants. The first article covered accounting for Groupon transactions. This piece covers how to set up your Point of Sale (POS) system to record  redemptions of coupons. Failing to do so properly could result in the restaurant being on the hook for a lot of sales tax, penalties and interest!

redemptions of coupons. Failing to do so properly could result in the restaurant being on the hook for a lot of sales tax, penalties and interest!

In the first article, we learned that HST applies to the “promotional value” of the Groupon coupon. In our example, the coupon was worth $100 of meals, and the customer purchased it for $50, which was paid directly to Groupon. The promotional value of the coupon is the $50, even though the restaurant does not receive this amount from Groupon. So, when the customer orders $100 worth of meals and drinks at a restaurant, she will have to pay tax on $50, but she will receive a credit for $100 (face value of the coupon).

Restaurants that use Groupon (or other similar programs) may need to update their POS systems to properly account for these transactions. Many POS systems can be easily modified by the user to make these changes, but some require programming by the developer (which can take time). Here are the changes you will need.

Continue reading “Groupon POS Implications”

Accounting for Groupon Coupons

While I’m not a fan of Groupon coupons, at least for restaurants, I felt compelled to write a few articles about it. Today’s piece covers accounting for Groupon coupons, because I’ve seen some really weird accounting recommendations and far-from-best-practices. As far as I know, none of the more unusual accounting has been suggested by real accountants!

While I’m not a fan of Groupon coupons, at least for restaurants, I felt compelled to write a few articles about it. Today’s piece covers accounting for Groupon coupons, because I’ve seen some really weird accounting recommendations and far-from-best-practices. As far as I know, none of the more unusual accounting has been suggested by real accountants!

Future articles will cover how to generate the proper entries in QuickBooks, how to set up your Point of Sale (POS) system to properly account for redemptions of Groupon certificates, and why you may be in for a huge shock when the tax man comes a knocking.

For what it’s worth, if you really, really think you need to use Groupon (or Living Social) coupons at your restaurant, at least get the accounting right. There are four types of entries that need to be made in your accounting system, which are:

Continue reading “Accounting for Groupon Coupons”

How to Compare Your Restaurant

It is almost impossible to compare a restaurant’s operations with industry averages. Organizations like the CRFA aggregate the smallest mom-and-pop with the largest chains to get their averages. Not many restaurants are “average”, anyway. Just about all industry statistics are based on surveys, not actual operating results. Even though such surveys are anonymous, who wants to put down that their cost of sales is 40% or more? So, the results are often skewed.

There is another way of compiling restaurant operating results.

Continue reading “How to Compare Your Restaurant”

Restaurant Fraud & Theft – Part IV

The first three posts in this series covered fraud and theft of products entering the establishment, food theft, and alcohol theft. Now, we’re going to look at outright theft of sales receipts. While it’s unlikely that your servers are grabbing handfuls of dollars on their way out the door, today’s post looks at several more sophisticated methods of achieving the same result.

Continue reading “Restaurant Fraud & Theft – Part IV”

Restaurant Fraud & Theft – Part III

“What I like to drink most is wine that belongs to others.”

Diogenes.

Today’s post looks at alcohol related thefts once the alcohol has made its way to the coolers and shelves in the bar. These types of alcohol theft are broad categories. Within each there are many scams, too many to list. As I have discussed many times on this blog and my tax blog, alcohol theft has dire tax consequences for a restaurant. In Canada, the total cost of the theft can easily be twice the cost of the stolen alcohol. That’s why it is so important to minimize theft in your operation.

Continue reading “Restaurant Fraud & Theft – Part III”